- #QUICKBOOKS DESKTOP PRO 2017 COUPON CODE FULL#

- #QUICKBOOKS DESKTOP PRO 2017 COUPON CODE SOFTWARE#

You can also use the Bezier Tool to create interesting and dynamic shapes for your graphic images. Reshape the curve, edit text, and change letter spacing. If text on a path provides the perfect visual solution, get creative with the Bezier Text Tool.

#QUICKBOOKS DESKTOP PRO 2017 COUPON CODE SOFTWARE#

Whether your running a business, advertising a garage sale or adding the finishing touches to a school project, Desktop Publisher Pro lets you tinker, tweak and outright torture text, plus create headlines and special effects like the best of the big-name publishing software at a fraction of the cost. This full-featured desktop publisher provides users far more control over the appearance of text than ordinary word processors. DesktopPublisher Pro flows text around graphics it allows you to link text boxes and precisely place text and graphic objects.

Enter txt directly into text boxes, cut and paste, or import from text files.

Both first-time users and experienced graphic designers will appreciate the intuitive powerful text handling capabilities of Desktop Publisher Pro.

#QUICKBOOKS DESKTOP PRO 2017 COUPON CODE FULL#

Using classic DTP* interface with user friendly tools, you'll enjoy to work with our publishing software.ĭesktop Publisher Pro is a high quality, low cost, full featured desktop publishing tool for the professional and novice alike.ĭesktop Publisher Pro delivers the power-packed desktop publishing solutions that power users need to transform concepts into stunning professional quality designs. Please contact us if you have any questions or would like Hawkins Ash CPAs to prepare your 2020 Form 1099s for you.Would you like to make high-quality publications such as brochure, newsletters or book template? Desktop Publisher Pro application is the ideal choice for business, education or home professionals.

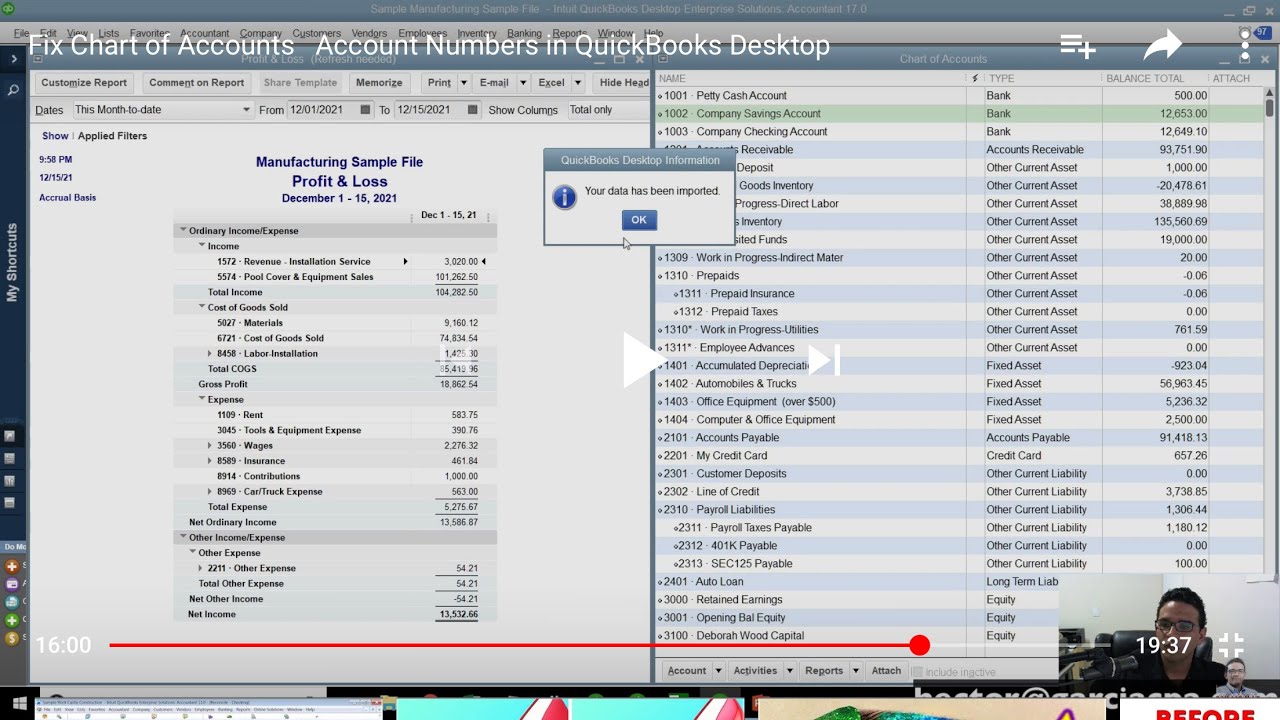

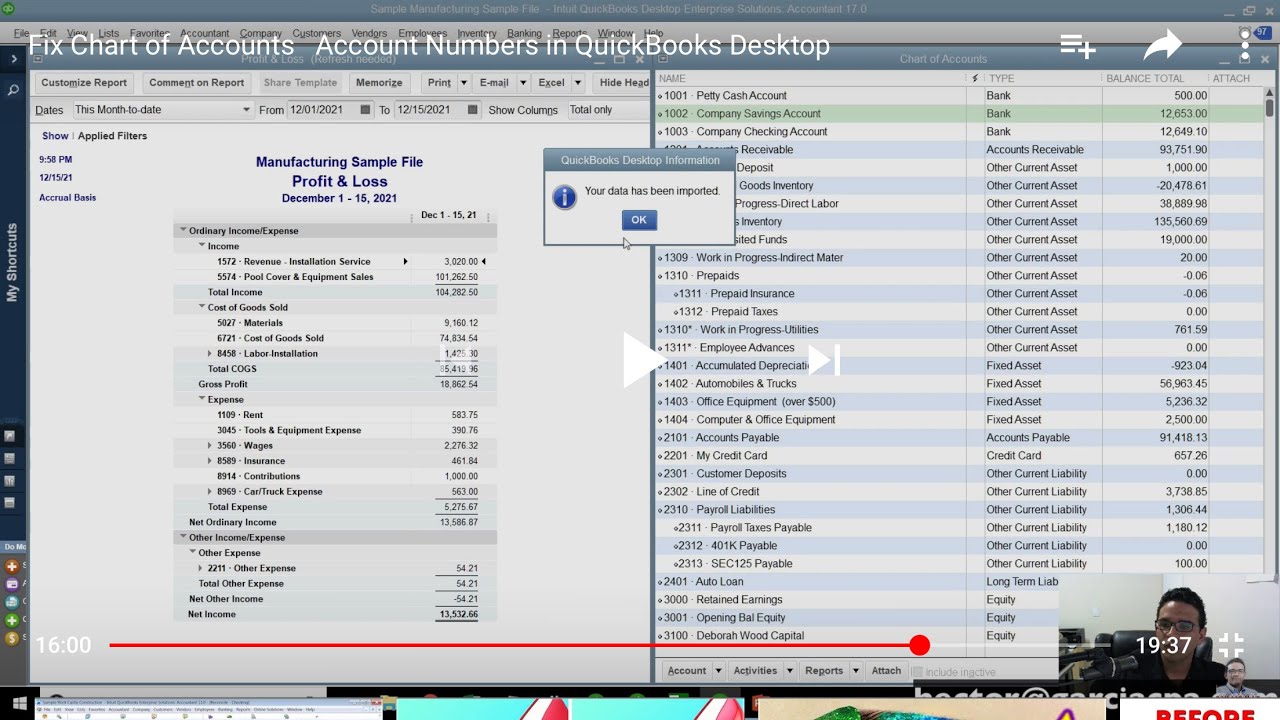

If you are satisfied with the 1099s, you can Print 1099s (you must have pre-printed forms) or Go to 1099 E-File Service (additional fees apply). Click Summary Report or Detail Report at the Confirm your 1099 entries window, click Continue (or click on Reports, Vendors &. Review the payments selected, click Continue. Select the correct 1099 box to apply the expenses, click Continue. Click on the drop-down menu on the right from Show 1099 accounts to Show all accounts. Verify the vendor information, click Continue. Review the vendor names and check the box to create the form, click Continue. Set up your expense accounts in QuickBooks: If the vendor refuses to provide their ID number, you should deduct backup withholding from the payments you make to them. If you do not have a vendor ID number, have them complete this form as soon as possible. All eligible 1099 vendors should complete IRS Form W-9 (Request for Taxpayer ID) when engaged for services. Click on the Tax Settings tab and verify the tax ID is correct and check the box that they are eligible for 1099s. Verify the names and addresses are correct. Find your 1099 eligible vendors in the Vendor Center and double click them to edit.

Make sure your vendors are set up properly:

Click Yes to filing 1099-MISC forms option. Open QuickBooks Desktop, go to Edit tab and select Preferences. Once you have set up your new general ledger expense account in your QuickBooks file, you can edit the vendor payments to move them from one general ledger account to another. A single account can only be used for each form. If you need to file both the 1099-NEC and the 1099-MISC for the same vendor, you will need to create a new general ledger expense account for the vendors that will be reported on the 1099-NEC. New for 2020: The IRS has separated nonemployee compensation onto a new form called the 1099-NEC.

0 kommentar(er)

0 kommentar(er)